21 October 2021 • NEWS

Climate finance: carbon offsetting is not the (only) solution

Alors que la COP 26 de Glasgow promet des discussions tendues sur le sujet du financement pour le climat, Planète Urgence a initié une étude à l’été 2021 pour mieux identifier les enjeux de financement des acteurs qui agissent sur le terrain, et notamment les ONG et fondations. Cette étude a été réalisée et diffusée avec le soutien de la commission Climat et Développement du réseau associatif Coordination Sud, de la Coalition française de Fondations pour le Climat et est complémentaire de l’analyse du marché carbone 2020 impulsée par Info Compensation Carbone.

Elle démontre l’urgence de repenser le financement du climat par les entreprises pour mieux servir l’intérêt général.

A- Le marché de la compensation carbone volontaire est en pleine explosion

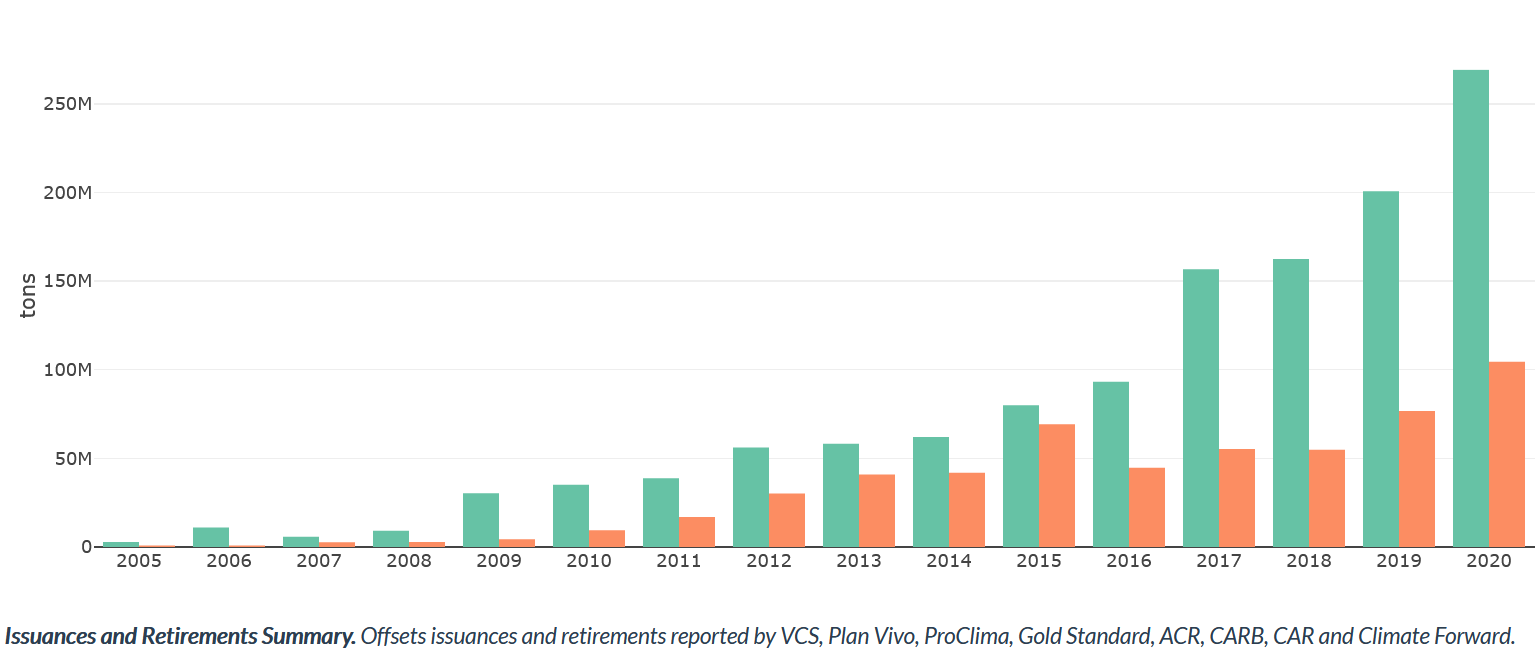

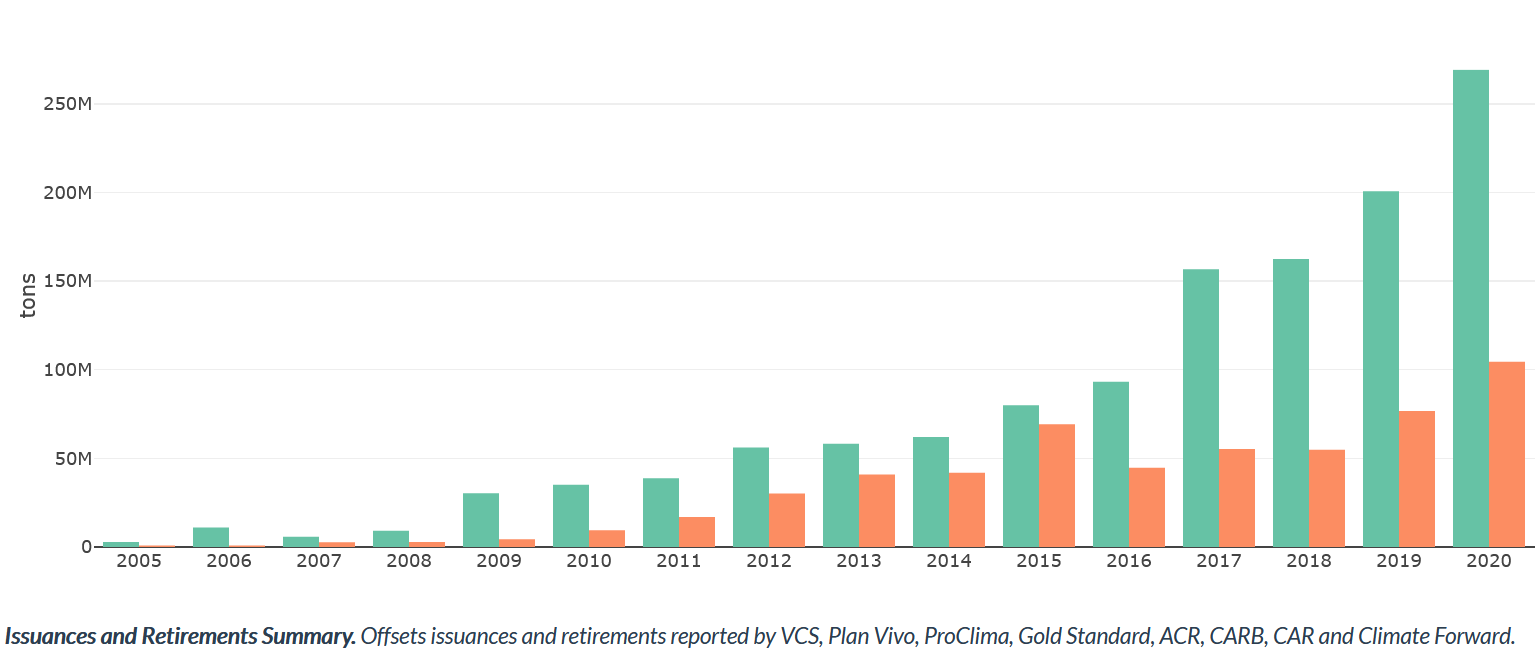

Le marché du carbone volontaire, destiné au secteur privé, voit ses volumes s’accroître de façon exponentielle. Il est passé d’environ 40 millions de tonnes de CO2 générés et vendus en 2010 à plus de 250 millions de tonnes en 2020. En 2019 le prix moyen à la tonne de carbone était en moyenne à 3,78 dollars.

Source EcoSystem MarketPlace : nombre de crédits carbone générés et vendus entre 2005 et 2020 dans le monde

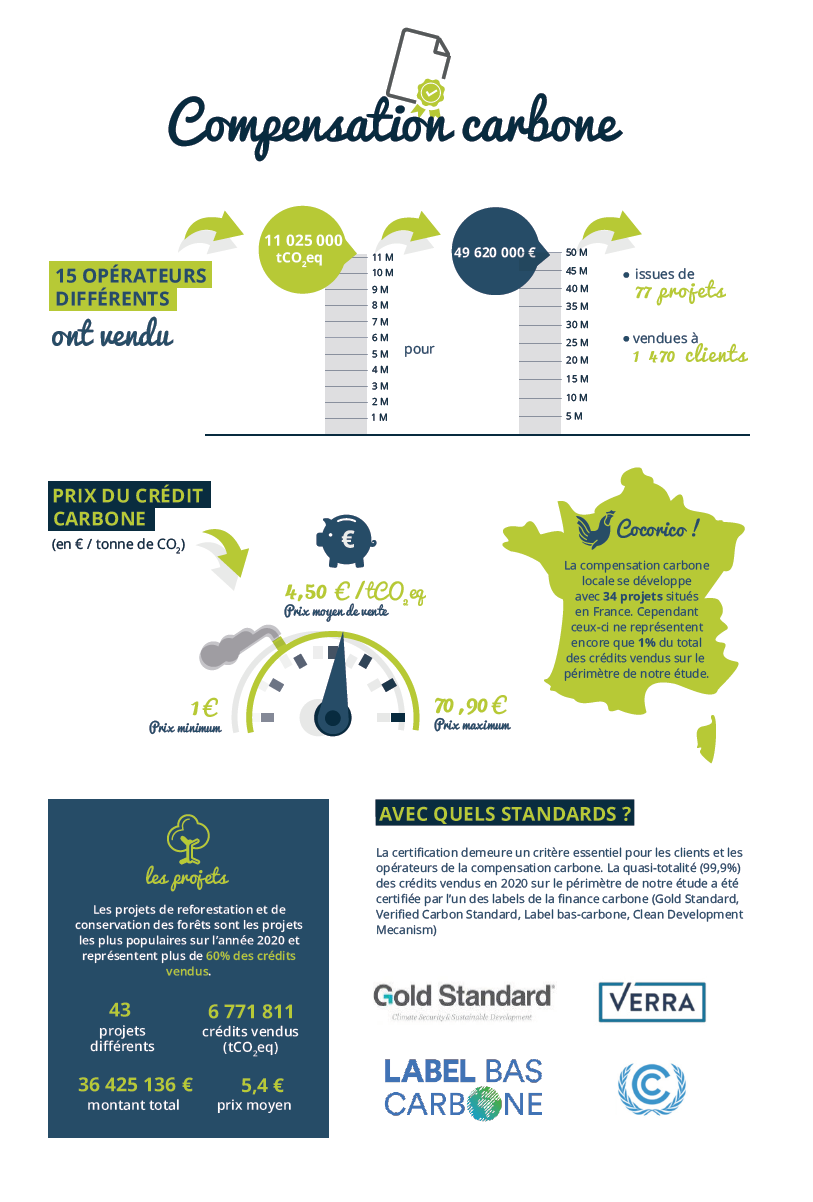

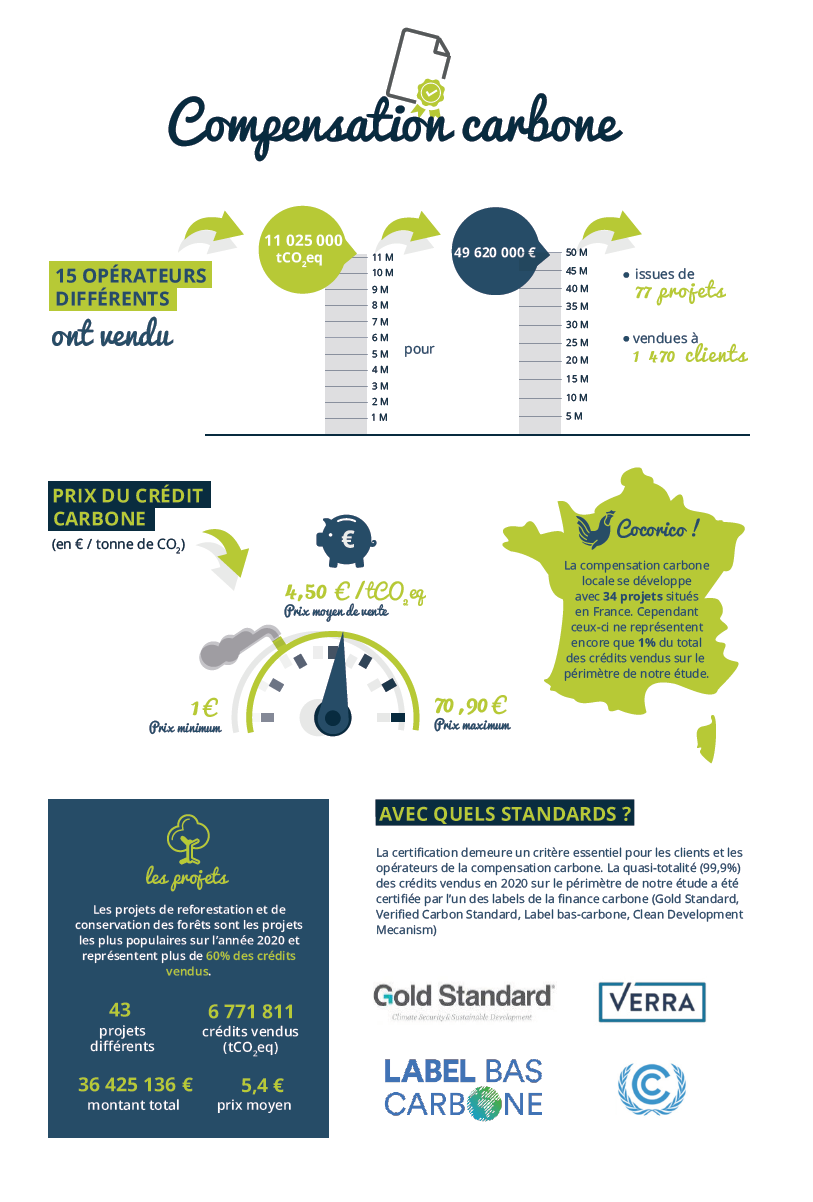

En France, le marché suit la même tendance avec une augmentation de 260% des crédits vendus entre 2016 et 2020 avec près de 7 millions de crédits vendus en 2020 à 5,4€ en moyenne.

Source Info Compensation Carbone : État des lieux 2020 de la compensation carbone

B- Le marché carbone n’est pas toujours adapté aux enjeux des porteurs de projets

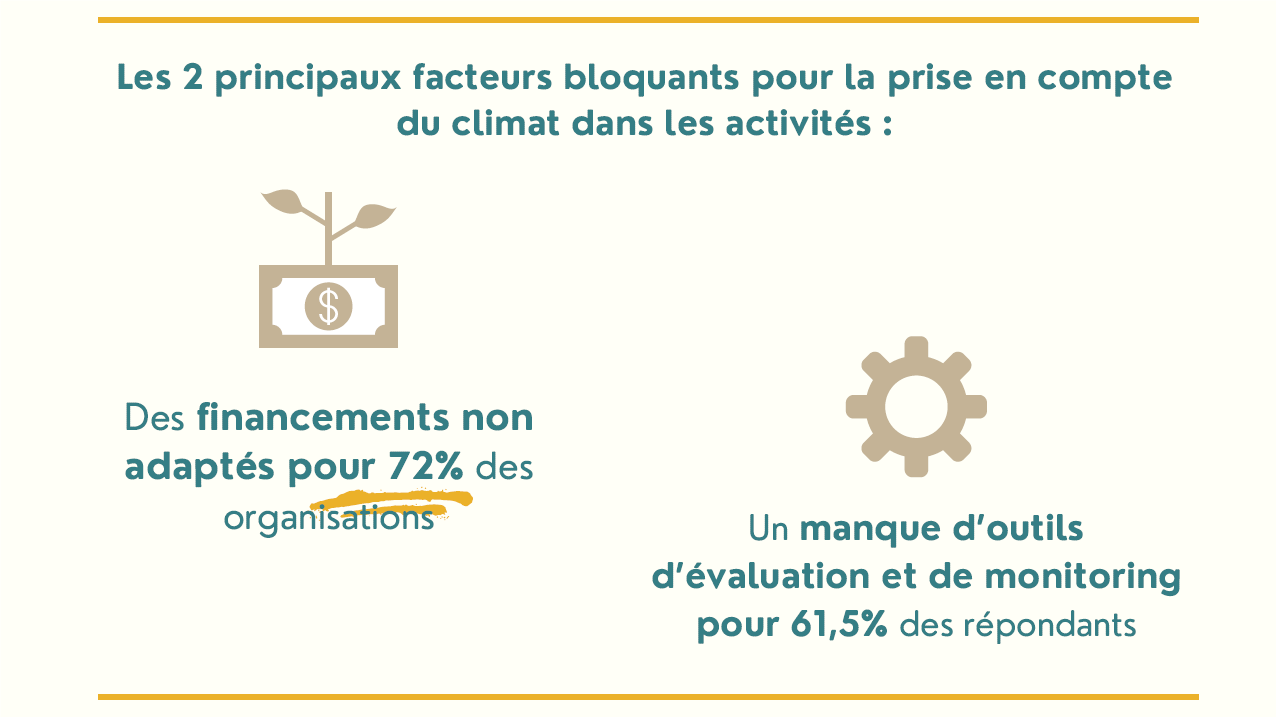

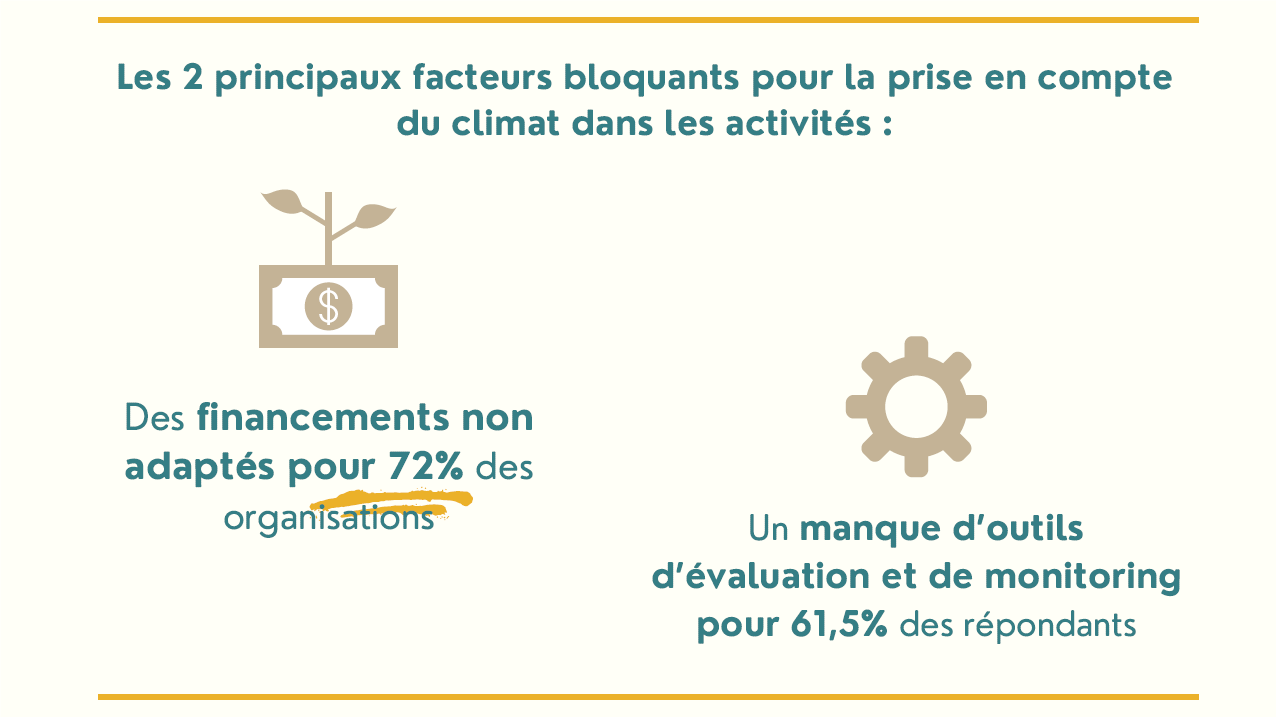

41 organisations d’intérêt général venant de 18 pays – en majorité des associations, fondations et fonds de dotation – ont répondu à une étude réalisée par Planète Urgence sur les enjeux du financement des projets ayant un impact sur le climat. D’après l’étude, 71,8% des organisations affirment que les financements actuels ne sont pas adaptés à leurs besoins en terme de financement de projets avec un impact sur le climat.

Source Planète Urgence : Étude 2021 sur les enjeux de financement climat des organisations d’intérêt général

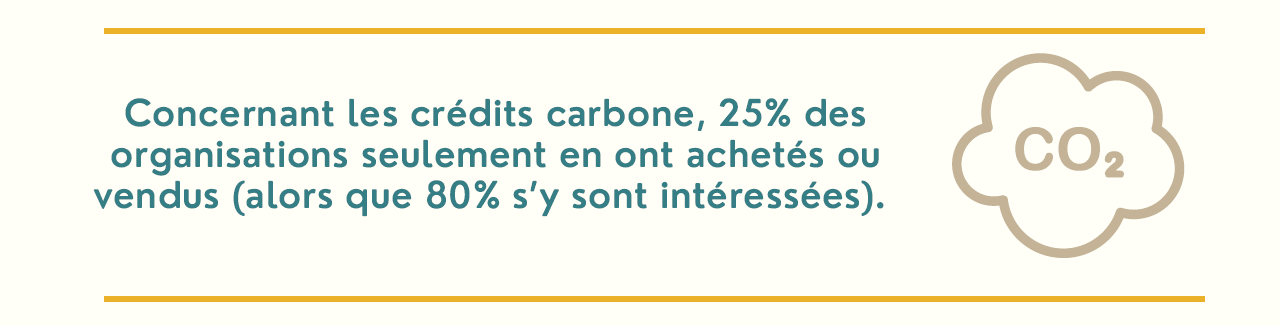

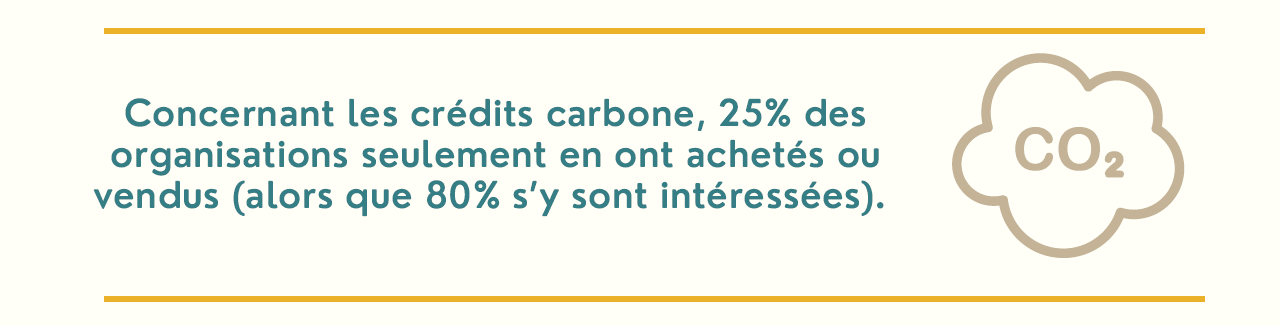

Malgré ces enjeux d’accès au financement, 24% des organisations seulement ont acheté ou vendu des crédits carbone, les autres sont récalcitrantes à s’y engager, car ce marché carbone est estimé aujourd’hui être trop complexe et incompatible avec des projets de qualité.

Source Planète Urgence : Étude 2021 sur les enjeux de financement climat des organisations d’intérêt général

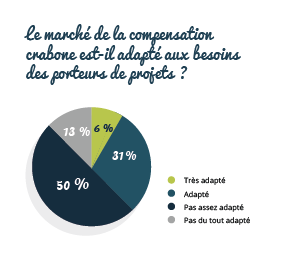

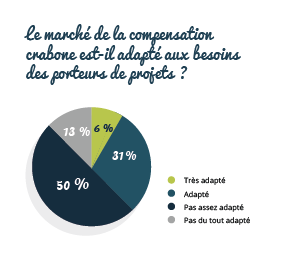

Les revendeurs eux-mêmes sont conscients de l’inadéquation de la finance carbone volontaire avec les besoins des porteurs de projets puisque seulement 37% pensent que le marché est adapté.

Source Info Compensation Carbone : État des lieux 2020 de la compensation carbone

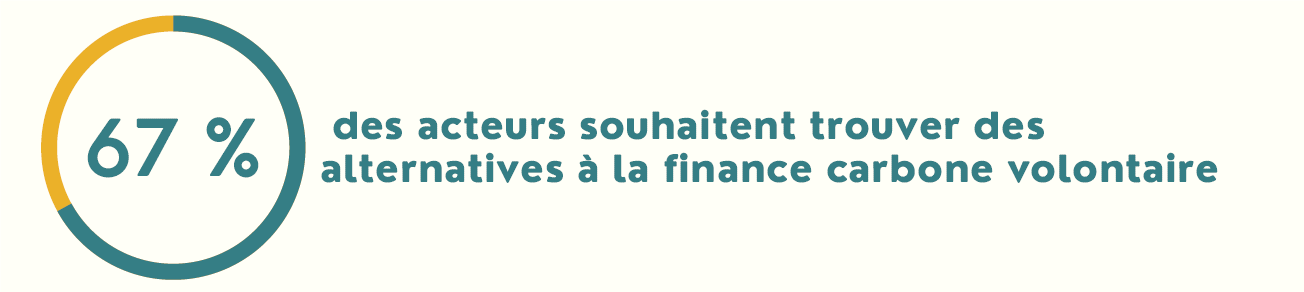

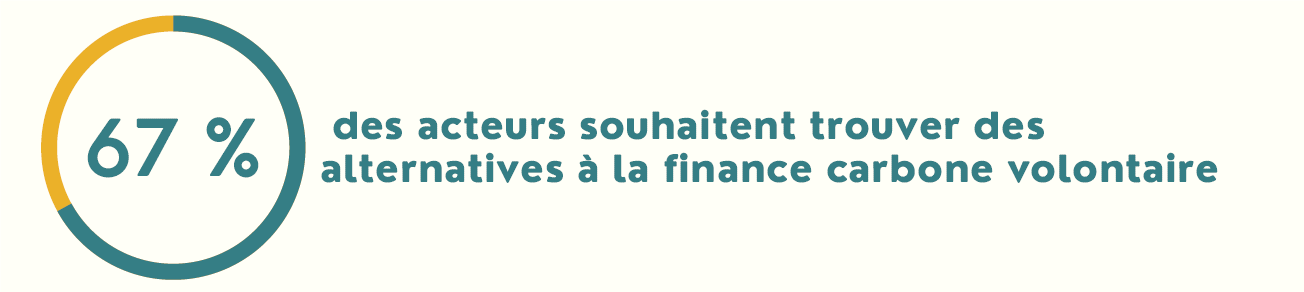

C- Les acteurs de l’intérêt général souhaitent qu’une réflexion approfondie soit menée afin de faire émerger une finance carbone cohérente avec les objectifs du développement durable

Source Planète Urgence : Étude 2021 sur les enjeux de financement climat des organisations d’intérêt général

3 alternatives émergent prioritairement pour les grands projets:- Du mécénat climatique avec une labellisation

- Du crédit carbone certifié avec un label de qualité sur d’autres bénéfices que le climat

- Des financements hybrides mécénat et finance carbone